Hourly paycheck calculator georgia

Before Tax Retirement. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas.

A Fetus Counts As A Dependent On State Tax Returns In Georgia Npr

Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

. Weekly pay results in 52 pay periods per year and is commonly used by employers who have hourly workers. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. You could win a FREE paycheck. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Cost of Turnover Calculator. Variable Workforce Cost Calculator.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. If you break these laws youll likely face penalties and finesand thats on top of the back pay youll owe the workers you underpaid. Income to be taxed as supplemental income.

Depending on the calendar year there are sometimes 27 pay periods which can increase payroll costs. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Just type in your info and preview on screen.

Need help calculating paychecks. Federal prevailing wage laws are just thatlaws. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

These calculators are not intended to provide tax or legal advice and do not represent any ADP. Switch to salary calculator. 2nd Shift Monday - Friday 200 pm.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month.

Instant Preview No software or download any install. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Instant Download If you like the preview you can download the PDF to print to see if you like it.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Below are your federal hourly paycheck results. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

Why is it important to understand prevailing wage as a business owner. Instant Email If you are on a tablet or phone and you cant download we can email it to you also. The results are broken up into three sections.

Texas Hourly Paycheck and Payroll Calculator. Free Federal and State Paycheck Withholding Calculator. Employees receive 26 paychecks per year with a biweekly pay schedule.

Both hourly and salaried employees may receive biweekly. It should not be relied upon to calculate exact taxes payroll or other financial data. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers.

Hourly Gross Salary per Pay Period. While it might be tempting to lower the cost of payroll by paying workers less its not a good idea. State Taxes Itemized and separate state taxes for all the greater 50.

Join us today at Trane Technologies in Vidalia Georgia. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Instead you fill out Steps 2 3 and 4.

Are you a team player. Important note on the salary paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida.

Apply Now More Info.

Georgia Paycheck Calculator Smartasset

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Collective Review An Honest Review Of The S Corp Back Office Tax Platform Upwork Tax Services Graphic Design Tips

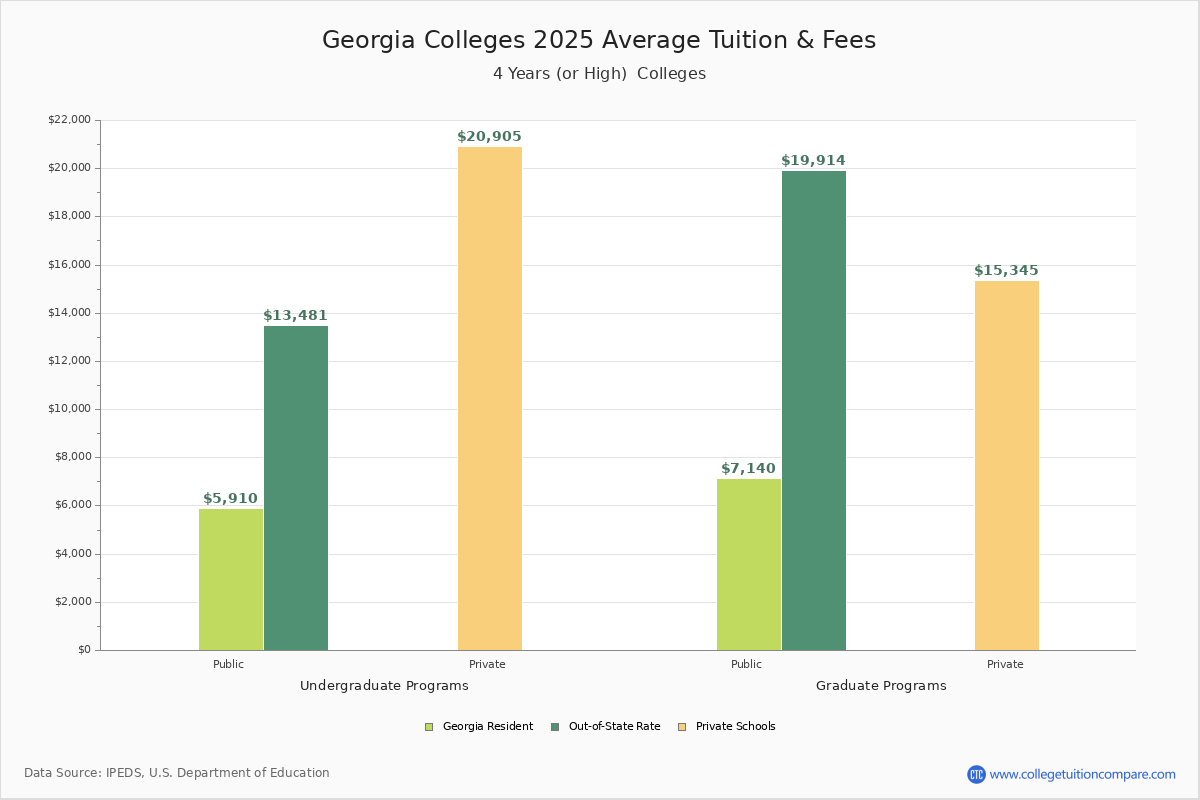

Georgia Colleges 2022 Tuition Comparison

Georgia Pacific Salaries Comparably

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

How To Calculate Child Support In Georgia 2018 How Much Payments

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

Payroll Software Solution For Georgia Small Business

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

Payroll Software Solution For Georgia Small Business

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Georgia Paycheck Calculator Smartasset

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

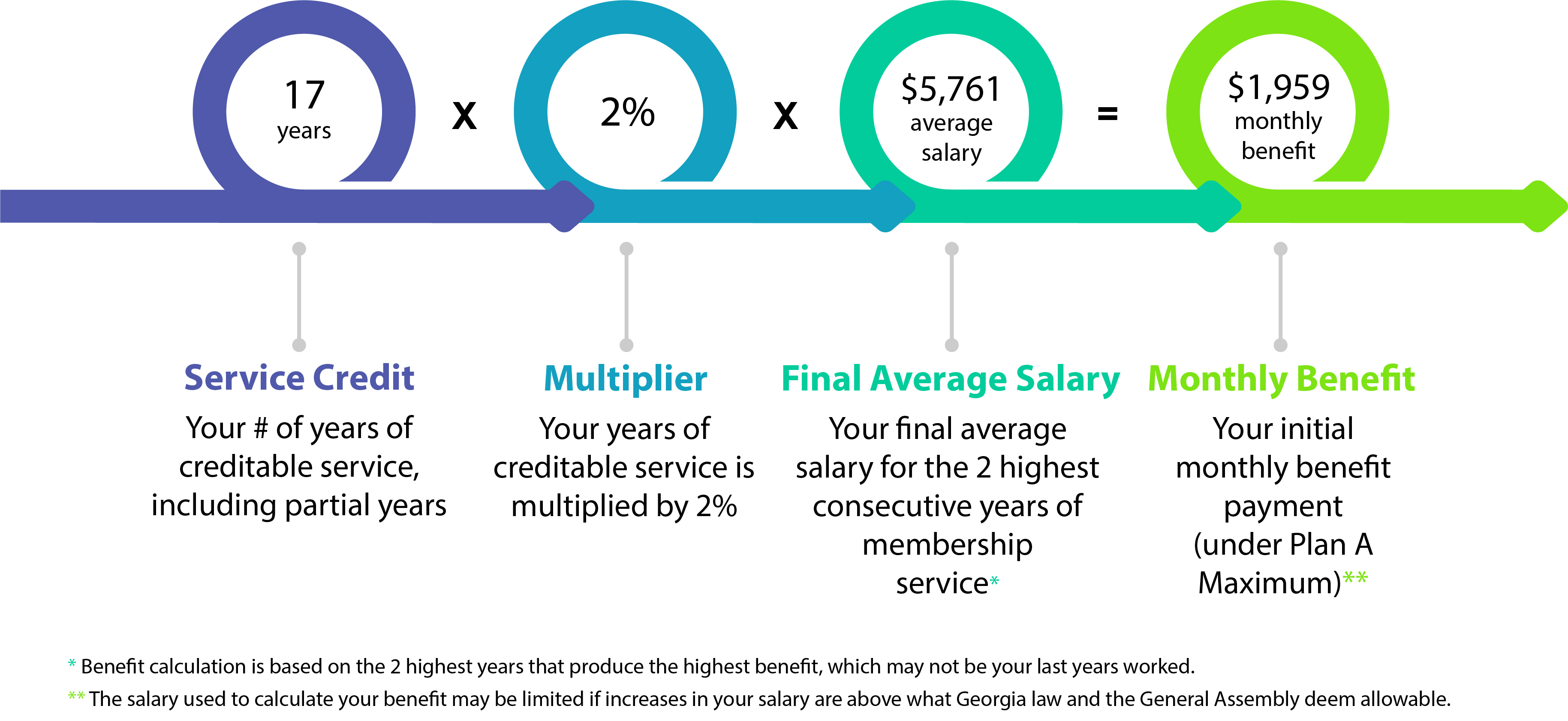

Teachers Retirement System Of Georgia Trsga

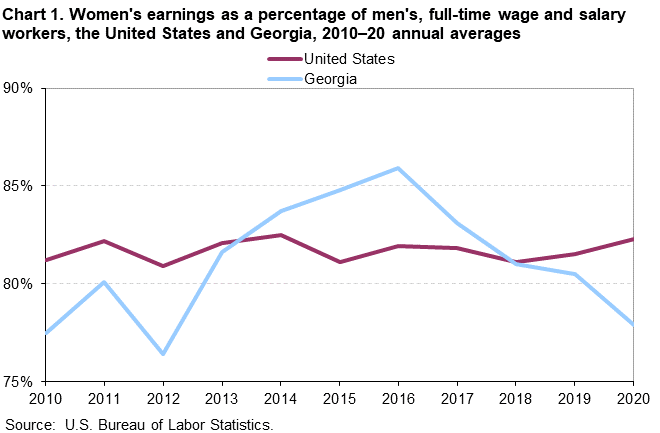

Women S Earnings In Georgia 2020 Southeast Information Office U S Bureau Of Labor Statistics

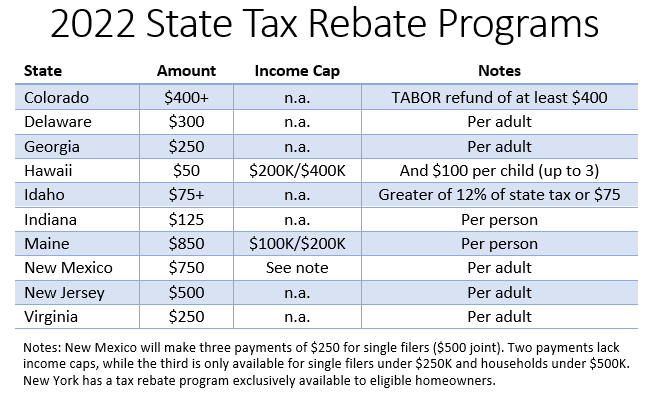

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca